When a customer misses a payment, the consequences ripple through an organization. Cash flow slows. Risk increases. Operational strain follows. That’s why credit collections statement processing—often viewed as a background administrative function—is a strategic frontline defense in managing financial health. It’s the intersection of timing, precision, and compliance where real dollars are either recovered or lost.

For organizations dealing with overdue accounts, especially in high-volume environments such as lending and collections, every mailed statement is more than just a reminder. It’s an opportunity to prompt resolution, prevent escalation, and maintain regulatory alignment. Done right, it reduces disputes, strengthens trust, and facilitates faster payments. Done poorly, it can introduce legal risk, customer frustration, and revenue leakage.

Statement Processing Is a Strategic Lever, Not a Reactive Task

At its core, credit collections statement processing refers to the structured delivery of communications that inform customers of missed payments, current balances, and potential consequences. But it’s not just about mailing a letter at 30, 60, or 90 days past due. The real value lies in how tailored, timely, and accurate those communications are—and how they fit into the broader collection strategy.

At its core, credit collections statement processing refers to the structured delivery of communications that inform customers of missed payments, current balances, and potential consequences. But it’s not just about mailing a letter at 30, 60, or 90 days past due. The real value lies in how tailored, timely, and accurate those communications are—and how they fit into the broader collection strategy.

Smart organizations treat these communications as proactive interventions. When statements are precise, timely, and data-rich, they prevent accounts from aging unnecessarily. They reduce the volume of calls to collections staff. They position the organization as competent, professional, and responsive, rather than desperate or reactive.

That begins with the way those statements are constructed and presented.

Variable Data Printing: Turning Every Statement Into a Smart Touchpoint

The days of one-size-fits-all dunning letters are gone. Today, statements must reflect not only the balance due but also the context of the account, namely, who the recipient is, their history, their payment behavior, and the urgency of their situation. That’s where Variable Data Printing (VDP) changes the game.

VDP allows each statement in a single print run to be unique, not just in name or address, but in message tone, content structure, graphics, and payment options. A borrower with a solid payment record but a recent slip might receive a supportive message and reminder of past good standing. Another with a prolonged delinquency may receive escalated language and a final notice format.

Color-coded visuals highlight due dates. QR codes route recipients directly to secure payment portals. Past-due amounts are bolded in context, making statements easier to interpret at a glance. Every detail works together to prompt understanding and action.

This level of personalization isn’t marketing fluff—it’s operational clarity. It ensures that the message aligns with the moment and provides each recipient with a clear path forward they can understand and trust.

Compliance and Accuracy: Non-Negotiables in Financial Communication

For credit collection agencies, mistakes in statement processing carry more than customer service consequences. They invite scrutiny, fines, and legal exposure. That’s why accuracy and compliance must be engineered into the process from the start.

At VariVerge, every credit collection statement is managed with 100% mail piece integrity. This means each document is individually tracked using 2D barcodes through every stage—printing, folding, inserting, and mailing. If a document fails any verification step, it’s pulled, reprinted, and rechecked before it moves forward. That closed-loop process prevents mis-mailing sensitive information, protecting the sender and reinforcing confidence with recipients.

Beyond physical controls, compliance is supported at the data level. Required disclosures based on geography, account type, or regulatory framework can be inserted dynamically. This ensures that statements not only meet legal requirements but do so without slowing down operations.

All of this is executed under SOC 1, Type II, SOC 2, Type II, and SOC 3 audited standards. These frameworks aren’t just checkboxes—they’re ongoing attestations of process rigor, data security, and system reliability.

Design That Improves Outcomes, Not Just Appearance

The best data in the world won’t help if the recipient can’t make sense of the statement. Document design plays a crucial role in the success of collections.  That’s why design expertise is baked into every statement VariVerge produces.

That’s why design expertise is baked into every statement VariVerge produces.

Statements are laid out for clarity. Payment options are placed where eyes naturally fall. Important figures—total due, due date, last payment—are visually separated from supporting details. Visual cues, such as boxes, arrows, and color distinctions, reduce misreads and speed up comprehension.

When customers understand what they owe, why they owe it, and how to resolve the issue, they’re more likely to take action. That lowers inbound call volume, shortens payment cycles, and leads to better outcomes across the board.

Seamless, Automated, and Scalable

In collections, consistency is king. You don’t want human error in data entry, missed inserts, or lost audit trails. That’s why automation is at the core of VariVerge’s processing model.

Everything starts with file-based job submission. Clients upload data files through secure channels, and the system handles everything from address standardization (including NCOA and ACS updates) to envelope composition and barcode assignment. Every envelope’s contents are matched, verified, and sealed under automation. There’s no manual collation. No chance for page swaps or insert errors.

And this automation isn’t reserved for large enterprise clients. VariVerge runs hundreds of distinct jobs per month across varying industries, statement types, and complexity levels. The system is built to scale without compromising on control.

Real-Time Oversight Through the VariTrack Portal

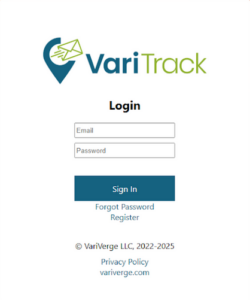

Knowing where a job stands shouldn’t require a phone call or email. That’s why clients get access to the VariTrack portal—a real-time dashboard showing job status, address corrections, and mailing confirmation.

Knowing where a job stands shouldn’t require a phone call or email. That’s why clients get access to the VariTrack portal—a real-time dashboard showing job status, address corrections, and mailing confirmation.

Clients can view which pieces were corrected, what data changed, and when the mail was dispatched. They can export reports, monitor trends, and identify problem areas before they turn into delays.

This level of visibility isn’t just convenient. It’s essential for operational oversight, internal audits, and managing third-party accountability.

The Bottom Line: Better Processing Means Better Recovery

Credit collections statement processing might not grab headlines. But behind the scenes, it’s one of the most impactful tools in a company’s financial toolkit. When every mailed piece is accurate, compliant, and personalized, it drives faster resolutions, stronger customer interactions, and lower administrative overhead.

For agencies navigating rising regulatory scrutiny, tightening margins, and demanding clients, that edge matters. It’s not just about sending mail—it’s about sending the right message, in the right way, at the right time.

That’s what VariVerge delivers.

Ready to strengthen your credit collections process? Reach out to our team or schedule a walk-through of the VariTrack portal. We’ll show you how better statement processing can improve outcomes across every stage of your collections cycle.