Tax Statement and Appraisal Notice Processing

For tax appraisers and assessment districts, tax statement and appraisal notice processing is a critical responsibility that requires precision, security, and efficiency. Handling high volumes of sensitive data, these offices face increasing pressure to protect personal information while delivering timely, accurate documents. VariVerge offers a comprehensive solution, allowing tax assessment districts to outsource statement processing and mailing confidently. Our SSAE 18-compliant services provide the security, cost-effectiveness, and reliability needed to keep your operations running smoothly and protect taxpayer data.

The Value of Secure Tax Statement and Appraisal Notice Processing

Tax statements and appraisal notices contain some of the most sensitive personal and financial data. A single breach of this information can lead to heavy fines, penalties, and even litigation, along with a loss of trust from taxpayers. By partnering with VariVerge, you gain access to advanced security measures and certified compliance protocols, including AICPA SOC 1, 2, and 3, demonstrating our data protection commitment.

Data Security and Compliance You Can Trust

At VariVerge, security isn’t just a priority, it’s part of our foundation. Our services are built on strict data protection protocols.

- SOC Compliance (SOC 1, 2, and 3): We meet the AICPA’s rigorous standards, validated by third-party audits, to ensure the secure handling of every tax statement and appraisal notice.

- SSAE 18 Compliant Procedures: These standards provide an extra layer of security, ensuring every document is processed with accuracy, confidentiality, and accountability.

Key Features of VariVerge’s Tax Statement and Appraisal Notice Processing

Secure Handling and Processing

Our tax statement and appraisal notice processing includes strict handling and formatting controls to protect sensitive data.

- Masking of Sensitive Information: Sensitive data like Social Security Numbers are masked to prevent unauthorized exposure.

- Full-Sheet Format: Document layouts are designed to prevent sensitive information from being visible through envelope windows, reducing data exposure risks.

Convenient Online Approvals

By moving tax statement and appraisal notice processing online, VariVerge allows tax appraisers and assessment districts to modernize and simplify document management.

- Centralized Document Storage: Access all tax records from a centralized digital database, making document retrieval quick and easy.

- Reduced Physical Storage Requirements: Digital document storage minimizes the need for physical space, lowering costs and reducing environmental impact.

- Enhanced Data Security: Digital storage adds another layer of protection to sensitive tax data, reducing the risk of loss or damage associated with physical files.

Benefits of Digital Document Management and Storage

The shift to digital document management benefits tax offices and taxpayers by making records more accessible, secure, and environmentally friendly. VariVerge’s digital solutions include:

- Simplify Audits: Centralized records make audits more straightforward and less time-consuming.

- Lower Environmental Impact: Reduce paper use and associated waste.

- Strengthen Data Protection: Enhanced security protocols help protect sensitive information.

Online Access and E-Filing Options

With VariVerge, e-filing and online document access are integrated into your workflows, making it easier for your team to manage the tax cycle from start to finish.

- Instant Confirmation for Taxpayers: Taxpayers benefit from instant confirmation upon submission, which provides peace of mind and reduces calls to your office.

- Reduced Manual Data Entry: E-filing reduces the need for manual data entry, minimizing errors and improving efficiency.

Technology Integration for Accuracy and Efficiency

Technology integration is crucial for accuracy in tax statements and appraisal notice processing. VariVerge’s solutions integrate seamlessly with accounting systems, enhancing precision and reducing administrative burdens.

Seamless Accounting Integration

Automated data capture from digital filings directly feeds into your accounting systems, ensuring all records are accurate and up to date.

- Real-Time Financial Data: Access real-time data to stay informed and make timely financial decisions.

- Minimized Errors: Automation reduces the risk of manual errors, helping your district deliver accurate tax assessments.

Real-Time Data for Better Decision-Making

Access to real-time data enables tax districts to make well-informed decisions quickly. With the latest data, districts can provide equitable tax assessments and manage resources more effectively.

Why Partner with VariVerge for Tax Statement and Appraisal Notice Processing?

Choosing VariVerge as your tax statement and appraisal notice processing provider means gaining a reliable partner focused on security, accuracy, and efficiency. Here’s why tax appraisers and assessment districts trust VariVerge:

- Industry-Leading Security Standards: VariVerge’s SOC compliance (SOC 1, 2, and 3) and PCI-DSS alignment ensure that taxpayer information remains secure.

- Proven Quality Control Measures: SSAE 18-compliant quality checks provide confidence that every document is accurate and complete.

- Scalability to Meet Your Needs: Whether handling thousands or millions of statements, VariVerge’s solutions scale to meet your tax district’s demands.

- Cost Efficiency Without Compromising Quality: Optimize costs with householding, automation, and streamlined workflows.

Start Simplifying Your Tax Statement and Appraisal Notice Processing with VariVerge

Let VariVerge handle your tax statement and appraisal notice processing with secure, efficient solutions tailored to your district’s needs. Contact us today to learn how we can help you streamline your operations, reduce costs, and enhance data security.

Tax Statement and Appraisal Notice Processing

Outsourcing the processing and mailing of tax statements and appraisal notices can be a smart business move for many companies seeking to increase savings and gain an extra measure of security, especially for those with tighter budgets or aging infrastructure.

Today, few documents contain more personal information than tax statements and appraisal notices. A single breach of personal or financial data can expose your company to costly fines, penalties, and even litigation.

In order to alleviate these concerns, VeriVerge has invested heavily in the latest security technologies and has SSAE 18 compliant procedures and controls in place to help guarantee the accurate, timely, and secure processing of every tax statement and appraisal notice.

Variverge’s Tax Statement and Appraisal Notice Processing:

- Secure Handling and Processing — including the masking of SSN and full-sheet format designed to prevent envelope-window exposure of recipient information.

- Secure Online Approvals — review and approve PDFs online anytime, at your convenience; view electronic production reports for count verification.

- Householding for Postage Savings — tax statements and appraisal notices identified with the same address may be programmed for insertion into the same envelope.

- Processing Tool — accessible through VariVerge’s statement or appraisal notice processing interface, this tool lets you conveniently edit or update tax form fields online, using the same statement or appraisal notices we access internally.

Quality Controls and Processes — SSAE 18 compliant measures ensure the accuracy and security of all form-related information during the processing of your documents.

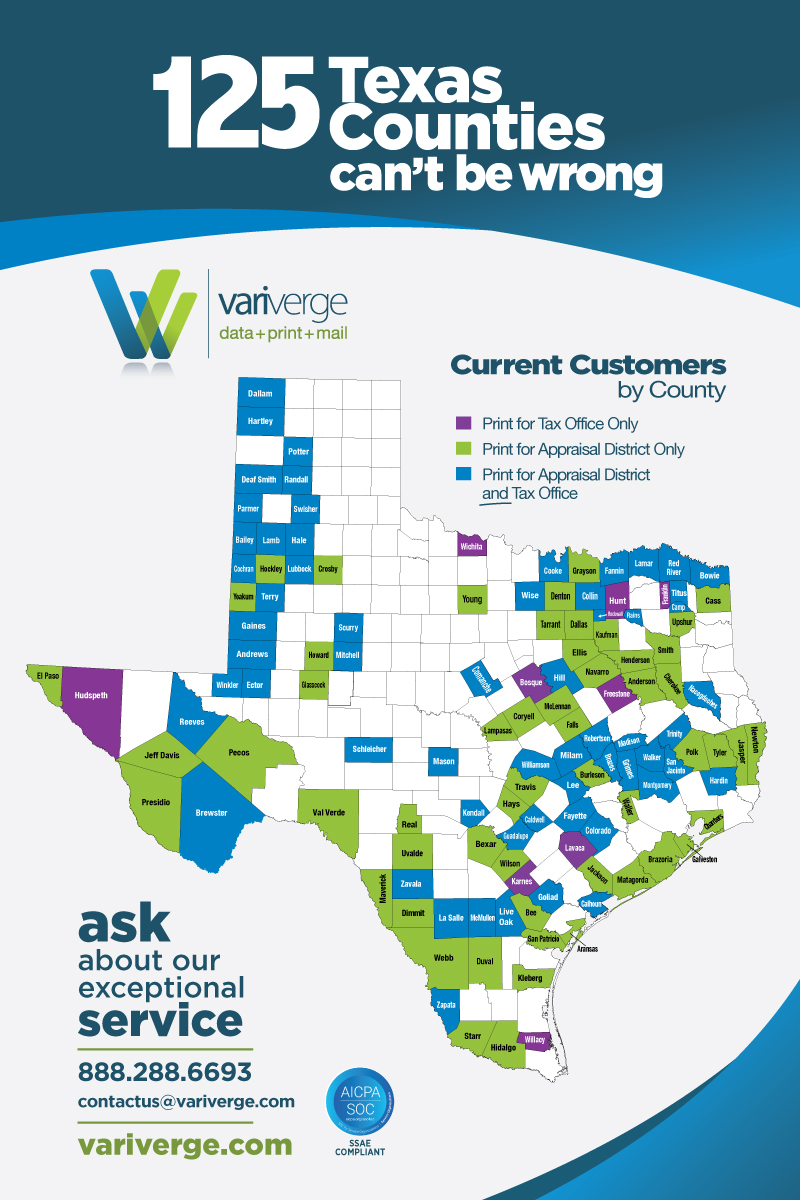

Dallas

Amarillo

920 SW 9th Avenue

Amarillo, TX 79101

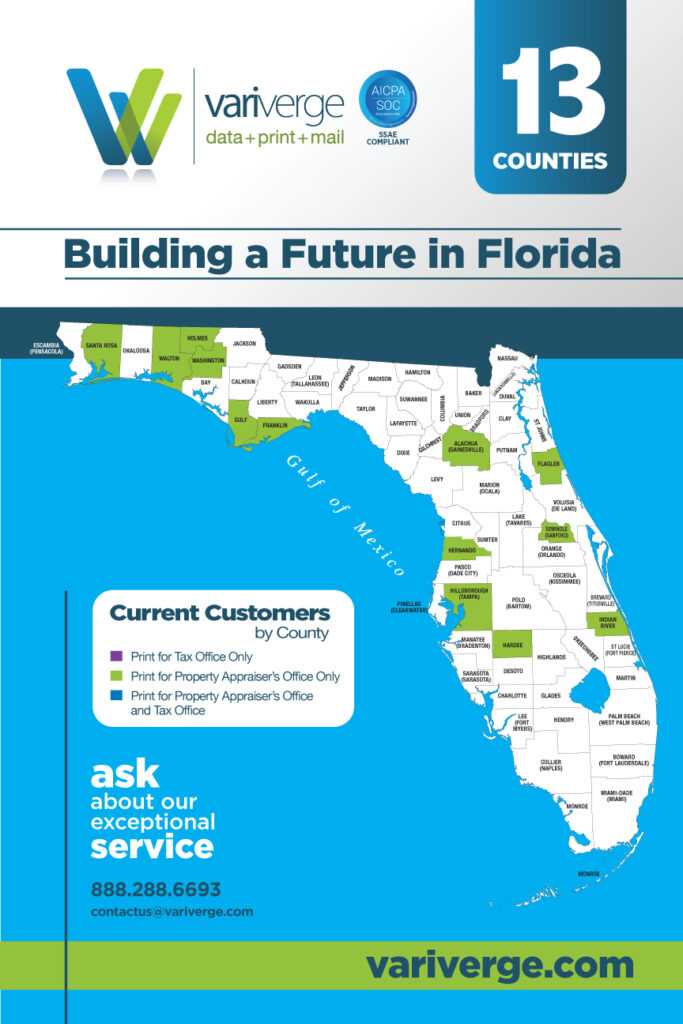

MEET VARIVERGE